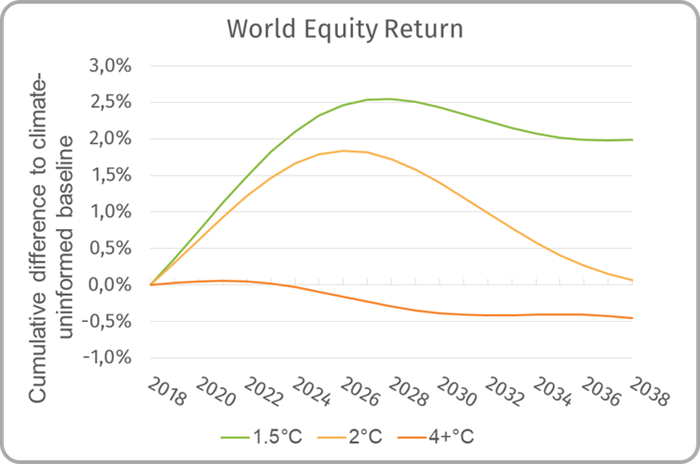

Fast-paced energy transition expected to increase world equity returns by 6 percentage points over the next ten years

Ortec Finance, a market-leading provider of technology and solutions for risk and return management, in partnership with Cambridge Econometrics, launches the first-ever Systemic Climate Risk Scenario Solution. The newly developed systemic climate-risk aware economic and financial outlooks show that a rapid shift to a low-carbon, climate-resilient economy is likely to generate more attractive returns for investors in the short term compared to a business-as-usual scenario.

World equity returns in a 1.5°C (orderly transition) versus a 4°C climate change pathway as compared to climate-uninformed market expectation.

Source: Ortec Finance Systemic Climate Risk Scenario Solution

For a fast-paced global energy transition to happen, it is assumed that companies, governments and consumers reduce their carbon emissions in an orderly manner so that average global warming is limited to 1.5°C. The quantified insights offered by Ortec Finance’s new systemic climate risk scenario solution highlight that a well-managed, sharp reduction of global carbon emissions holds large opportunities for investors. Drastically lowering emissions requires vast investments in new technologies, green infrastructure, energy efficiency and human capital development – all strong fundamental drivers of economic growth and investment return. Failing to transition in an orderly manner, on the other hand, implies forgone returns in the short run and may even lock investors into a situation of persistently lower growth. This is because the physical impacts of higher degrees of warming structurally undermine our planet’s ability to support human economic activity.

“Developing this solution really brought home the message that systemic climate change-related risks are material to strategic investment decision-making. We, therefore, consider systemic climate risk alongside all other economic and financial risk drivers. Traditional financial modelling, such as for ALM/SAA, can now be offered with climate risk-aware insights.” - Ton van Welie, CEO Ortec Finance

Ortec Finance’s research shows that it is key for investors to take the systemic nature of climate change-related risks and opportunities into account. Climate change will not only affect companies at an individual level, but will also fundamentally impact how the economy performs as a whole. Currently, most investors seem to focus on managing climate risk by engaging with, and potentially divesting from individual companies and other holdings. ‘Stock-picking’ is likely to be insufficient to manage the broader, knock-on effects on the economy since GDP, interest rate and inflation are seriously impacted by climate change.

The Ortec Finance systemic climate risk scenario solution is the first tool of its kind to integrate quantified systemic climate risks and opportunities associated with different global warming pathways into traditional multi-horizon real world scenarios sets. These systemic climate-risk aware scenarios sets enable investors to enhance their investment strategy through:

- Understanding systemic climate risk scenarios & exploring impacts on strategic asset allocation

- A strategic governance framework for climate action based on climate-aware ALM/SAA

- Climate-aware risk management: Assessing financial impact and materiality of climate change on different asset classes within portfolio

- Fulfilling forward-looking scenario-based analysis in line with disclosure recommendations, such as TCFD, UN PRI, EU Sustainable Finance Action Plan

About Ortec Finance

Ortec Finance is the leading provider of technology and solutions for risk and return management. It is Ortec Finance’s purpose to enable people to manage the complexity of investment decisions. We do this through delivering leading technologies and solutions for investment decision making to financial institutions around the world. Our strength lies in an effective combination of advanced models, innovative technology and in-depth market knowledge.

Headquartered in Rotterdam, Ortec Finance has offices in Amsterdam, London, Toronto, Zurich and Melbourne.

- 20+ countries represented

- 500+ customers

- 96% retention rate

- 3 trillion euro total assets managed by our clients

More information about the Ortec Finance Climate & ESG Solutions is available here.

About Cambridge Econometrics

For over 30 years, with over 30 economists, skilled in analysis and modelling across a wide range of areas, Cambridge Econometrics have provided valuable insight to its clients on a wide range of economic, societal and environmental issues. Their quantitative approach to data analysis and economic modelling gives users valuable insights based on evidence.

Cambridge Econometric’s world-renowned global, macro-econometric model (E3ME) is designed to address major economic and economy-environment policy challenges. Developed over the last 20 years, it is one of the most advanced models of its type.

More information about Cambridge Econometrics’ E3ME model is available at here.