Central bank network NGFS has recognized Ortec Finance’s Scenario Analysis for Systemic Climate Risk as one of tools that can be used to analyze the potential impact from transition and physical risks associated with climate and other environmental factors on financial institutions.

Case studies of Environmental Risk Analysis Methodologies is the second occasional paper published by the Central Banks and Supervisor’s Network for Greening the Financial System (NGFS). It provides a comprehensive review of the tools and methodologies for Environmental Risk Analysis (ERA) used by a few dozen financial institutions (FIs) including banks, asset managers and insurance companies. For the NGFS the term ‘environmental risks’ refers to both environment- and climate-related risks.

Ortec Finance is proud to have been recognized by the Central Banks and Supervisor’s Network as one of the third party-service providers that can support FIs with their assessment and analysis of environmental risks.

- Misallocation of resources

- Scenario Analysis for Systemic Climate Risk

- Thinking critically about assumptions

- Integrating climate risk consistently

- What investors should be asking themselves

- Choosing the appropriate pathway

- Read the full report and NGFS press release

Misallocation of resources

We share the observations of the NGFS that environment- and climate-related risks associated with environmentally unsustainable assets are still underestimated by many FIs. At the same time FIs under-appreciate many green and low-carbon investment opportunities, leading to an excessive allocation of financial resources to environmentally unsustainable assets and under-deployment of financial resources to green assets. This misallocation of resources contributes to the difficulties in measuring and pricing environmental externalities.

Scenario Analysis for Systemic Climate Risk

In our contribution to Case studies of Environmental Risk Analysis Methodologies, we focus on climate scenario analysis from a systemic risk perspective as used in our tools Climate MAPS and Climate PREDICT.

From our work with the different models and tools in our Climate & Environmental Solutions COMPASS, we already know that transition and physical climate risks have systemic consequences. Their impact can be deduced from indicators such as GDP growth, interest rates, inflation, carbon pricing, technology, international trade flows and other considerations. These so-called climate-adjusted risk drivers in turn affect risk-return expectations across all asset classes, regions and sectors.

Scenario analysis is a powerful method for assessing uncertainty. It supports FIs in making informed decision today about how they can best reach their objectives in an uncertain future. Insights gained from climate scenario analysis allow pension funds, asset managers, banks and insurance companies to make better informed strategic investment decisions, including Asset Liability Management (ALM) and Strategic Asset Allocation (SAA) approaches with the aim of achieving greater climate resilient investment portfolios and loan books.

Thinking critically about assumptions

Climate risk is not captured by most traditional scenario assumption building methodologies. Traditionally, assumptions on how GDP, interest rates and inflation develop, and how they influence financial performance, are based on historical relationships and historical averages. As there have not been significant periods of climate change in the period on which there is economic and financial data available, it is barely reflected in the historical data.

Integrating climate risk consistently

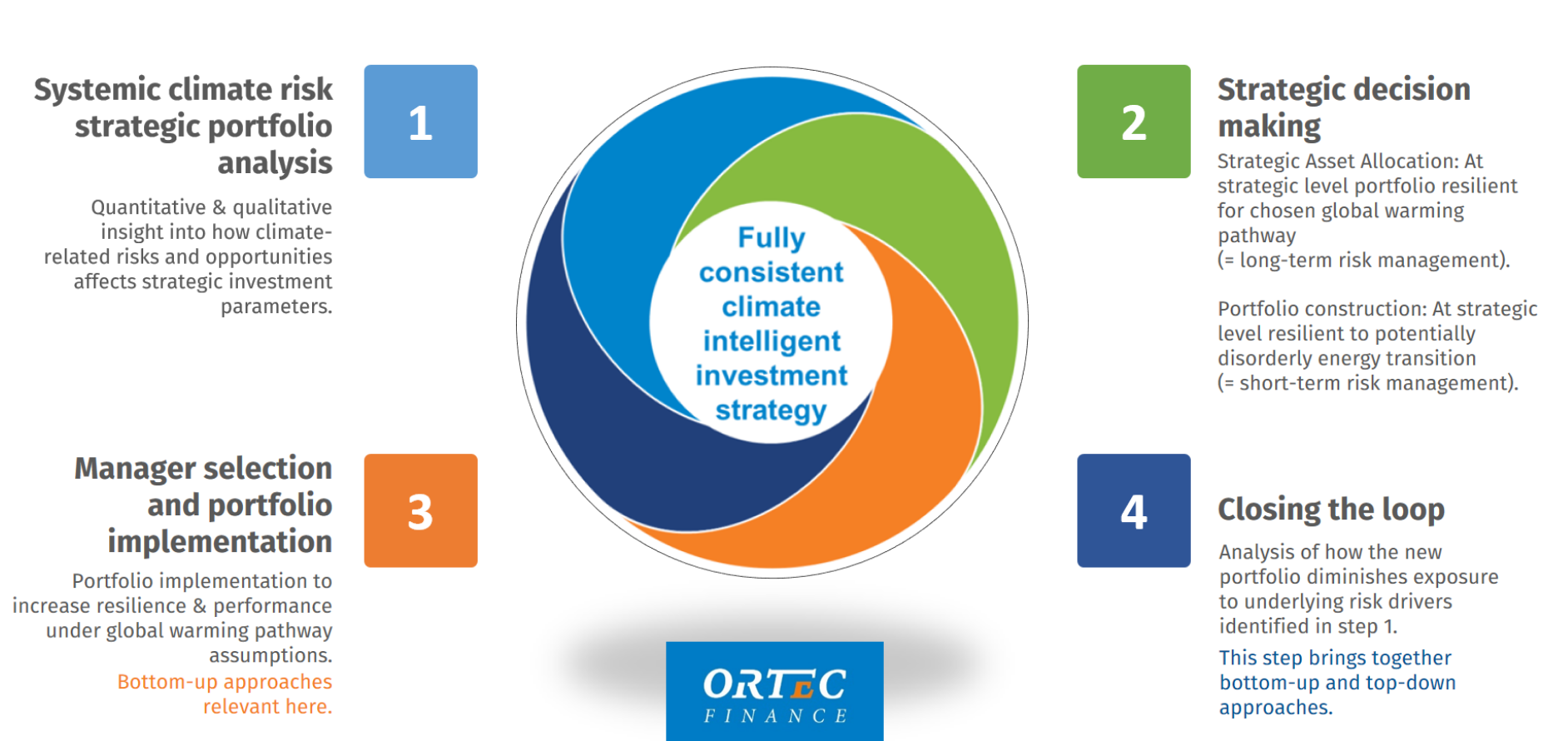

Integrating climate-related financial risks should be done consistently throughout the entire investment process: from the strategic to the implementation (holding selection) level. In order to design this consistent climate-informed portfolio it is important that asset owners and asset managers cooperate closely in order to achieve this consistency. In the figure below, we have described how we see the ideal process.

What investors should be asking themselves

Before starting to integrate climate-related risks and opportunities into SAA/ALM, investors may want to ask themselves the following questions:- Does my organization recognize climate as systemic risk?

- Are my climate risk datasets able to capture the networked impacts of both physical and transition climate-related risks and opportunities? (or are they assuming companies operate in isolation?)

- Are the assumptions used in the scenario methodology for ALM/SAA climate-informed or are they only based on historical, backward-looking information?

- Are my projected return estimates reasonable under different global warming pathways (see below)?

- What risks and opportunities are relevant for me on which time horizon?

- How will climate-related risks affect my funding or solvency ratios?

- Is the management of climate-related financial risks implemented consistently across the different steps of the investment process: from asset allocation, to manager selection and portfolio implementation?

Choosing the appropriate pathway

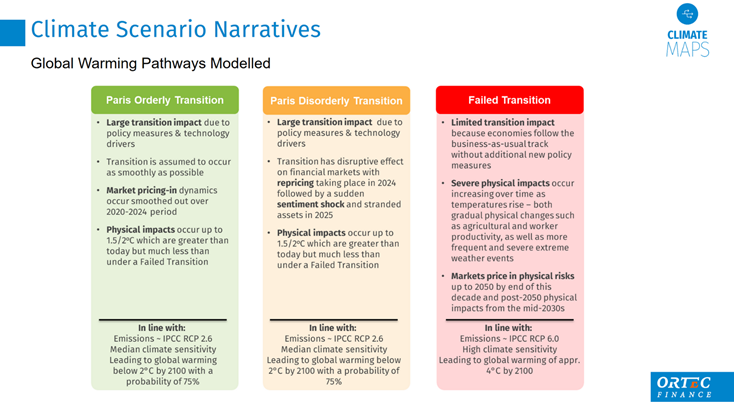

Investors should also ask themselves whether key assumptions used for modelling risk and return projections remain valid under different global warming pathways. A scenario approach considering different plausible climate futures may be more appropriate. Ortec Finance works with three different pathways.

How our approach works in practice is described in part 3 of chapter 18 of the Case studies of Environmental Risk Analysis Methodologies published by the Central Banks and Supervisor’s Network for Greening the Financial System (NGFS).

See the full report with chapter 18 on Scenario Analysis for Systemic Climate Risk by Ortec Finance Climate & ESG Solutions - along with many other useful case studies by other authors.