Goals-based investment planning brings clarity and comfort to clients around the investment decision making process and empowers advisors to take a proactive approach to portfolio construction with OPAL Wealth!

Use institutional-grade economic models to convert your clients’ personal financial goals, and risk appetite into a suitable investment portfolio and monitor the advice with OPAL Wealth.

OPAL Wealth enables advisors to provide timely and insightful advice at scale. The result is more engaged clients, enhanced relationships, consistent advice and, ultimately, a wealth management business that can scale and grow.

Key benefits

- Incorporates your client’s risk capacity and risk willingness

- Generates portfolio insights

- Aligns capital market assumptions and model portfolios across all divisions and client segments

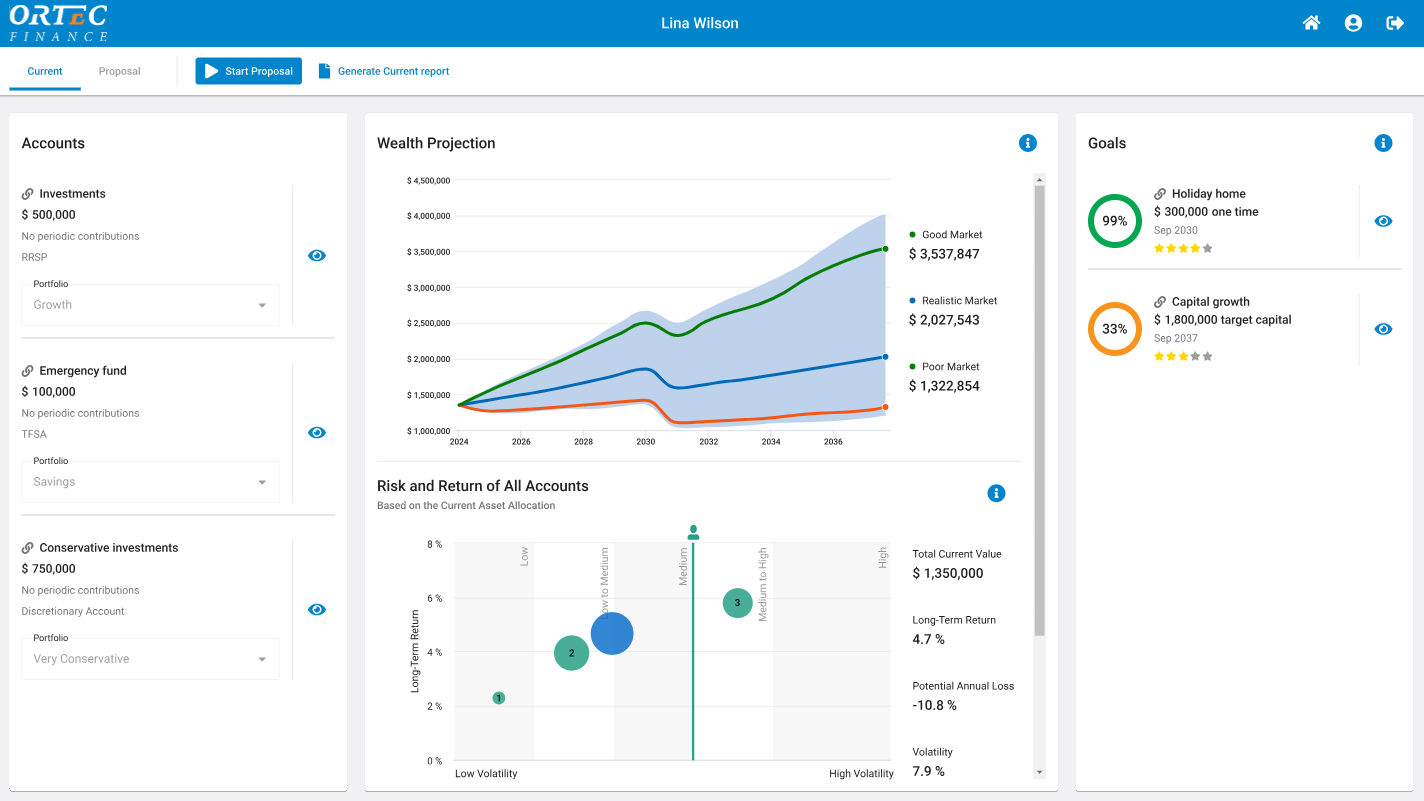

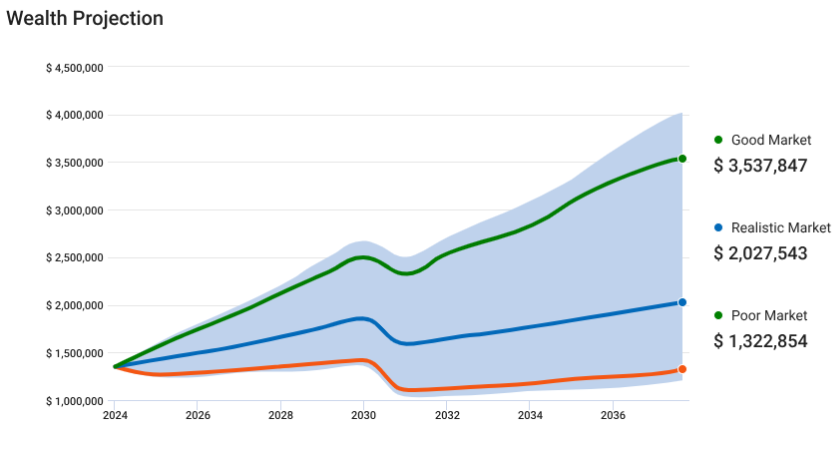

- Realistic economic scenarios to create realistic wealth projections

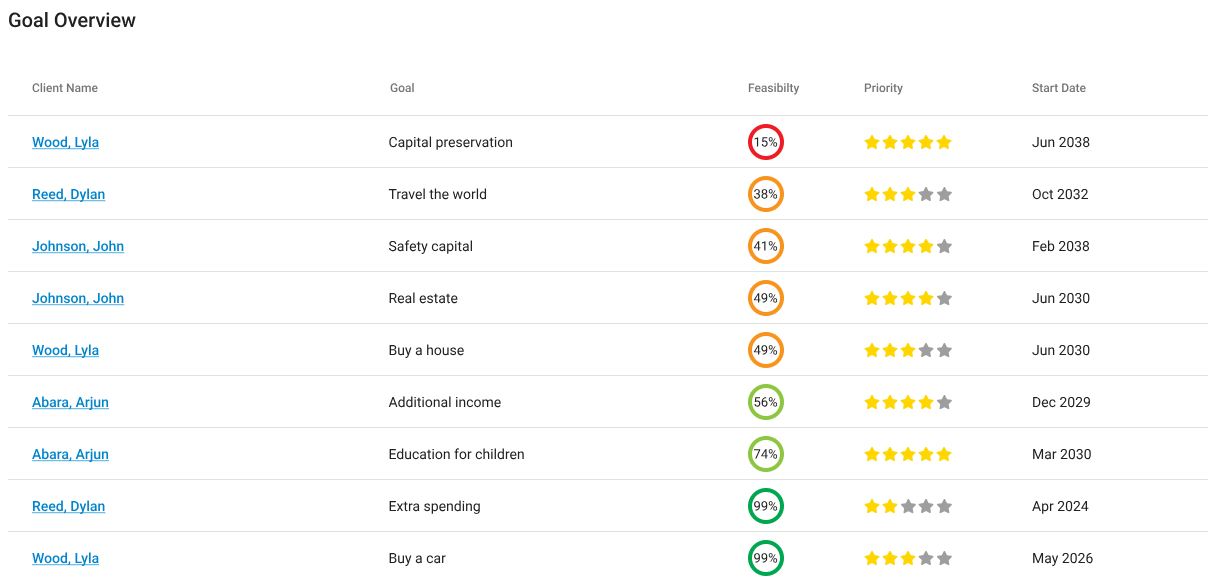

- Monitoring client portfolios and goals at scale

- Alerts advisors when goals are off track or need optimization

- Fully compliant with local legislation & regulations

- Enhances client engagement whilst increasing client trust

Institutional-grade economic projections, updated monthly

The Economic Scenario Generator is the core of OPAL Wealth – and is the same economic model used by more than 500 institutional clients, global asset managers, pension plans, sovereign wealth funds and government entities.

Using OPAL Wealth, advisors can now apply these institutional knowledge and capabilities to individual client accounts at scale to construct and optimize portfolios, track long term funding goals, and monitor risk.

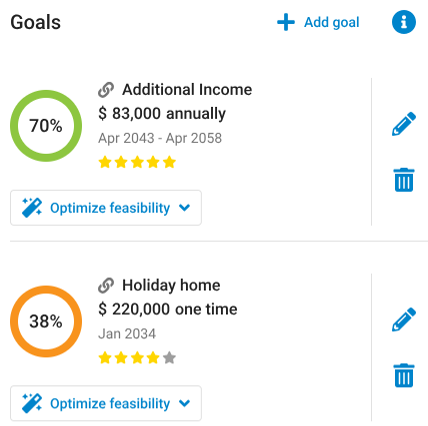

Client goals

Client goals can be captured and managed directly in OPAL Wealth. Multiple goals can be connected to multiple accounts, and goals can be prioritized based on client preferences.

Optimization techniques for deposits, goal horizon and risk capacity enable the advisor to deliver consistent, timely advice to clients.

Advisor Dashboard & Monitoring

Easily monitor and filter for goals that are off track based on goal feasibility to alert which clients are off-track achieving their goals. Test potential solutions based on automated suggestions through what-if analysis.

Results can be used to generate client proposals and communicate the required adjustments and insights. Once approved by the client, the changes can be executed in the portfolio management system and/or the plan.

Suitability monitoring

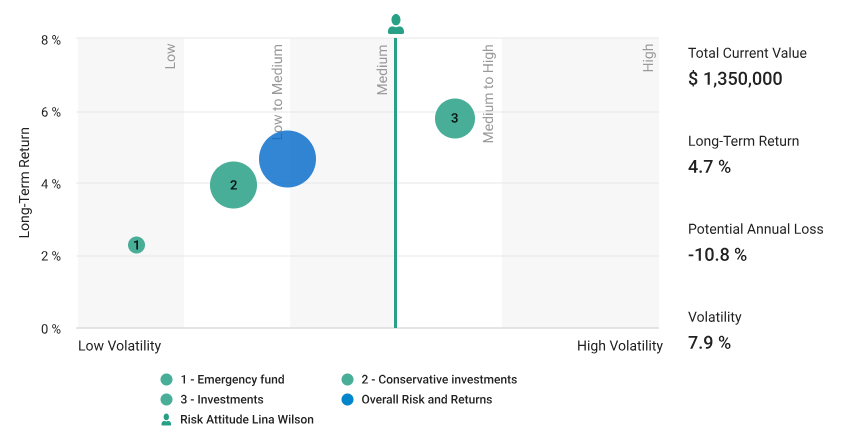

Incorporates risk attitude allowing for proper management of client expectations and active engagement with clients around risk capacity and risk willingness.

Want more information? Book a demo via the button below.

Scalable solutions for all advice channels

The OPAL Wealth solution is available through APIs as well as a plug and play advisor user interface.

OPAL Wealth API allows to implement the capabilities directly into existing platforms or client-facing web applications, supporting robo-advice client journeys, hybrid advisor experience or other technology platforms. The user interface can be linked to external data sources, supports single sign on and the look and feel can be adjusted to provide a seamless experience for the user.

OPAL Wealth UI supports advisors and their clients through their goal(s) based advice journey. Our UI has all the features and benefits needed to connect (multiple) goals to (multiple) portfolios and monitors these goals over time. It also supports the next level of suitability, providing insight into risk/return when making portfolio decisions. No need to build it on your own, just connect and go.

A few of our clients

Contact

Mark Glover

Managing Director – Head of UK Wealth Management