Insurance companies issue guarantees that need to be valued according to option prices which capture market expectations. Moreover, for asset liability management and regulation purposes, insurers also need future values of these guarantees. The current common practice is to assume that the option implied volatilities remain constant when calculating future values. It is, however, well-known that these implied volatilities are not constant over time but depend on the state of the economy.

At Ortec Finance, we developed an approach that is able to determine future values of guarantees without assuming constant implied volatilities over time. Instead, the option market is driven by real-world indicators such as the VIX index and interest rates. By including these indicators, we are able to capture important stylized facts of the option market, for example, the implied volatility in the market increases during a financial crisis. These stylized facts will lead to more accurate estimations of future guarantee values.

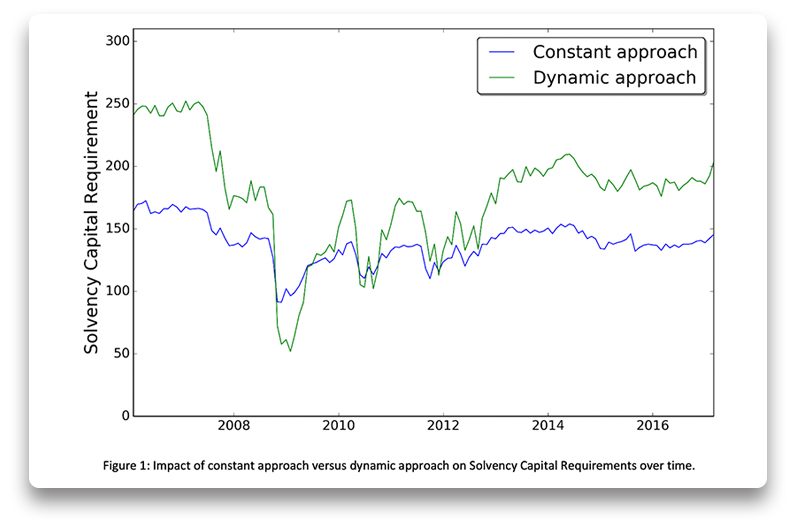

As an example, we demonstrate the impact of the approach on Solvency Capital Requirements. Compared to the constant implied volatility approach, the impact of the dynamic approach on the Solvency Capital Requirements varies between -46% to +52%, see Figure 1. More information on this topic can be found in our publication.

.png?w=576&hash=ACDB68A89AC45F798869837DDC9018AE)