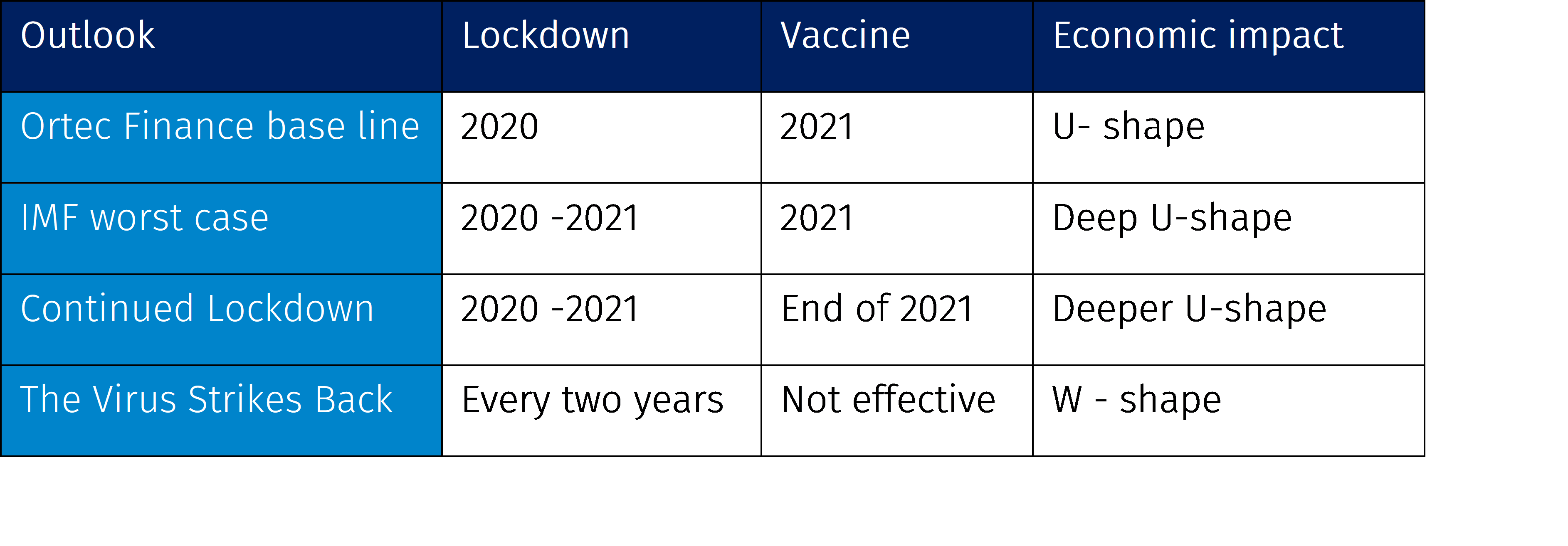

Informing management and the board on the possible financial consequences of this crisis by performing (what-if) scenario analysis is crucial in such a situation. For that purpose, Ortec Finance, in partnership with Cambridge Econometrics have defined four COVID-19 scenarios, including the year-by-year expected impact on economic and financial asset class returns per scenario.

How is your investment portfolio or solvency-ratio positioned for a deep economic recession yet with a steady recovery on the short and medium-term (1-5 years)? Pension and insurance companies can use these scenarios to assess the robustness of their investment portfolios and solvency position (e.g. for ORSA) for various COVID-19 scenarios. Get a head start and be fully informed, enabling you to enhance your decision-making process and improve discussions with your stakeholders.

More information?

Please download the whitepaper or contact:

Contact

Tessa Kuijl

Managing Director Goals-Based Wealth solutions

Patrick Tuijp

Head of Global Clients Scenarios & Asset Valuation

Edwin Massie

Senior ConsultantRelated Insights

Contact

Contact

Tessa Kuijl

Managing Director Goals-Based Wealth solutions

Patrick Tuijp

Head of Global Clients Scenarios & Asset Valuation

Edwin Massie

Senior Consultant