Climate change is a complex systemic financial risk

Identify and understand how physical climate risks, low-carbon transition impacts and associated market pricing responses could affect investment portfolios, financial markets and economies.

ClimateMAPS is Ortec Finance’s top down climate scenario analysis solution, in exclusive partnership with Cambridge Econometrics, that enables financial institutions to quantify climate change risks and identify opportunities, across all asset classes, macroeconomic variables and sectors.

Prepare for climate change. Translate plausible climate futures into quantified financial impacts.

Measure, monitor and manage total portfolio risk and opportunities

Why manage climate risks with ClimateMAPS? Our climate scenario analysis solution, which primarily utilizes our in-house Ortec Finance Climate Scenarios is:

![]()

Comprehensive

By translating climate risk and opportunities into all asset classes, macroeconomic variables, conventional and green benchmarks and regions and sectors.

![]()

Realistic

By delivering a real-world assessment of systemic transition, physical and market pricing risks

![]()

Integrated

By utilizing a range of advanced models to deliver results that can be integrated with traditional risk analysis and asset liability management (ALM) platforms

![]()

Our climate scenario analysis solution is also available with NGFS Phase V climate scenarios. Learn more about the differences and how to choose the right scenarios to meet your investment objectives.

Climate scenarios can also be customized to a financial institution’s views and assumptions as a bespoke climate scenario.

Utilizing Ortec Finance Climate Scenarios

Deliverables |

Application |

|

AnalyticsEconomic variables for 20+ countries/regions 450+ financial variables across all asset classes, including green benchmarks |

AnalysisUnderstand the financial impacts and outcomes under a wide range of plausible climate change futures |

|

Insights30+ sector-specific impacts for equities Geographical insights including heatmaps |

Stress-testPerform a total portfolio climate stress testing exercise

|

|

AssessmentComprehensive total portfolio analysis including dataset and detailed supplementary report |

Strategy designIntegrate climate change into investment beliefs, capital and strategic asset allocation as well as selection and monitoring |

|

BreakdownIn-depth breakdown of transition, physical and market pricing climate risks for all macroeconomic and asset class impacts |

Risk managementAssess and mitigate climate change from a financial risk management perspective |

|

DashboardInteractive web-based tool featuring dynamic charts, videos and explanations for comparison, with ongoing support and training |

ReportingUndertake stakeholder engagement and climate-related reporting and disclosures |

Translating the cost of climate change for pension funds and insurance companies worldwide

Our Climate Scenarios & Sustainability team undertake an annual analysis to assess how climate risk is affecting pension funds and insurance companies globally, using the latest release of our Ortec Finance Climate Scenarios

Climate scenario analysis for financial institutions

ClimateMAPS can meet the climate risk management needs of diverse financial institutions. Learn more about how our climate scenario analysis solution can specifically assist pension funds, insurance companies and asset managers with managing the impacts of climate change.

Understand total portfolio exposure across traditional investment and climate risks

Using ClimateMAPS to identify the impacts on asset class returns of optimized portfolios generated based on ALM studies against the same baseline determined in GLASS.

Support private asset investment decisions

Combine regional, sectoral, macroeconomic, and asset-class impacts to identify private asset opportunities and actively drive investment in the low-carbon transition from a total portfolio perspective.

![]()

Our climate risk management insights

Webinars

Evaluating the pricing impacts of

climate risks

Watch our webinar to explore how our climate change affects asset performance and valuations.

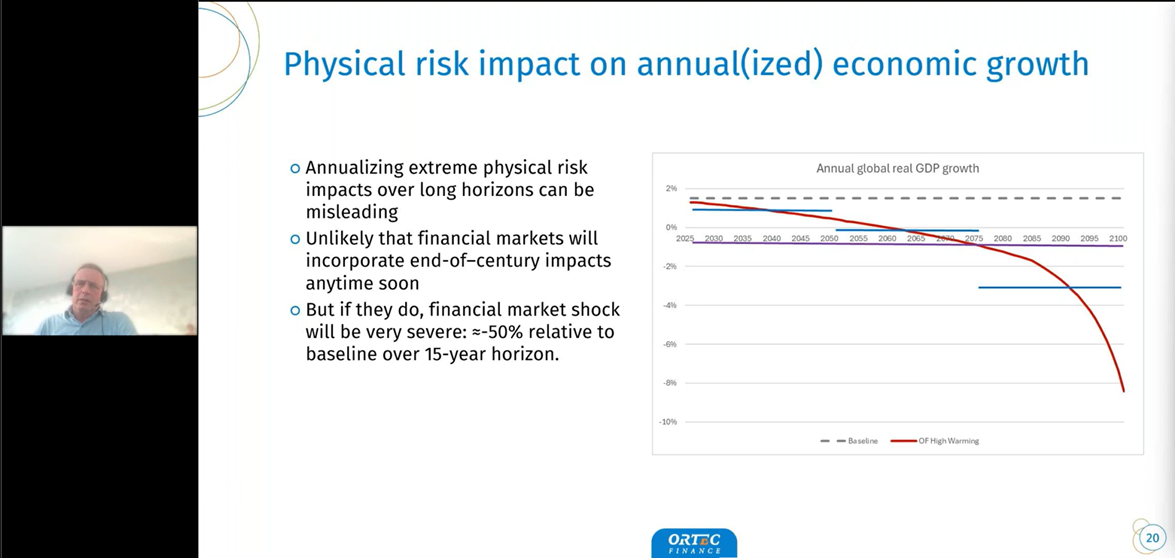

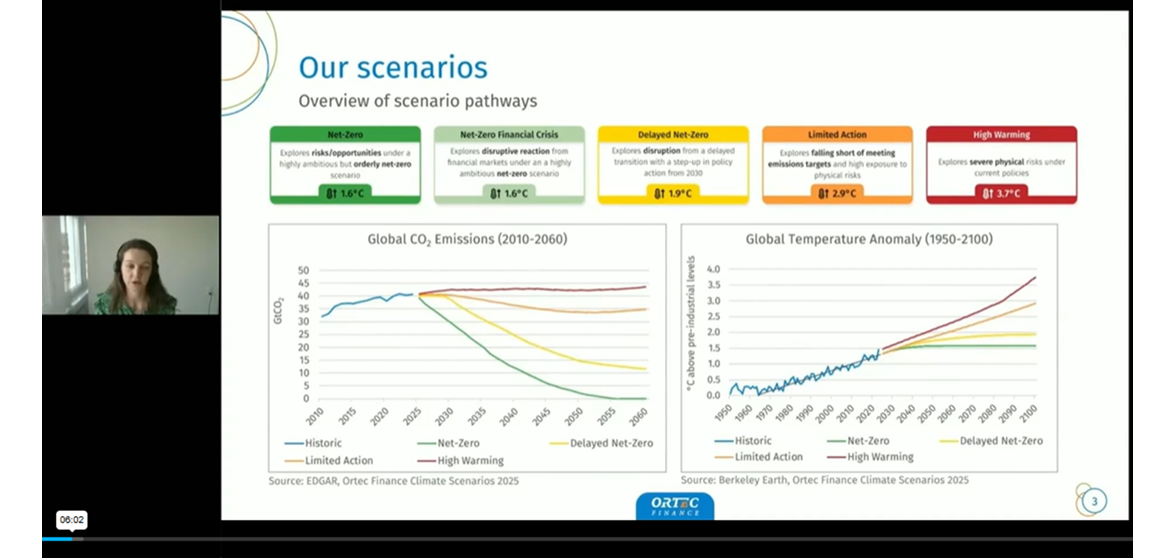

2025 Ortec Finance Climate Scenarios

Watch our webinar to learn how our Ortec Finance Climate Scenarios realistically assesses physical, transition and market-pricing climate risks.

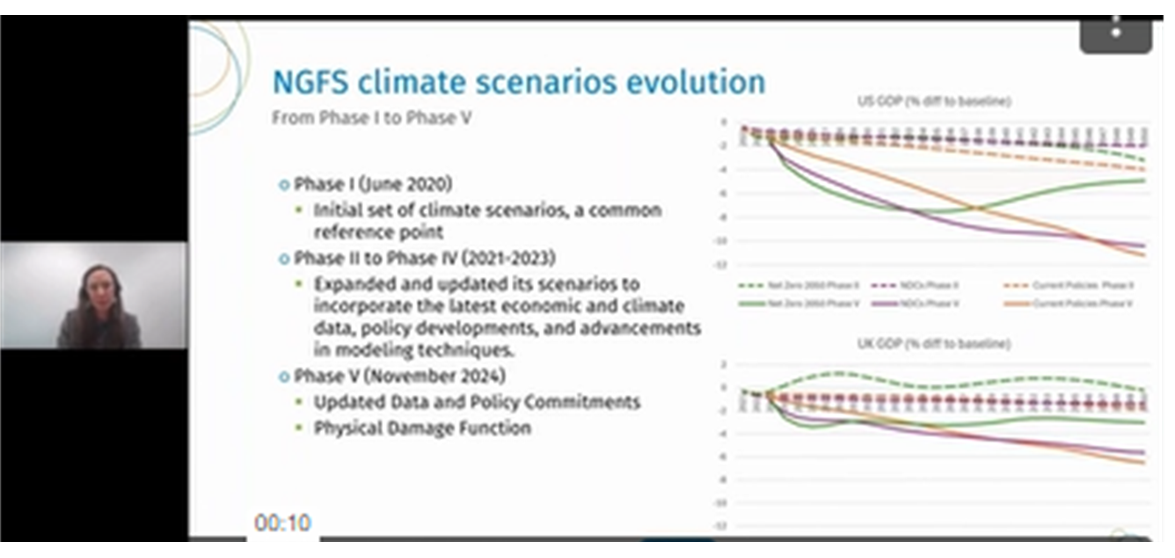

Utilizing NGFS climate scenarios for climate risk analysis

Watch our webinar to understand how NGFS climate scenarios can be utilized for assessing the financial impact of climate change.

Want to learn more about how ClimateMAPS can help financial institutions prepare investment portfolios for the impacts of climate change?

Receive the latest sustainable finance and climate risk management insights

Subscribe to Radar

Contact

Maurits van Joolingen

Managing Director, Climate Scenarios & Sustainability

Hamish Bailey

Managing Director UK, Head of Insurance & Investment

Richard Boyce

Managing Director, North America

Stefano SJ Lee

Managing Director - Asia Pacific